- #QUICKBOOKS DESKTOP PAYROLL SALARY PAYOUT VACATION HOW TO#

- #QUICKBOOKS DESKTOP PAYROLL SALARY PAYOUT VACATION UPDATE#

- #QUICKBOOKS DESKTOP PAYROLL SALARY PAYOUT VACATION PRO#

- #QUICKBOOKS DESKTOP PAYROLL SALARY PAYOUT VACATION CODE#

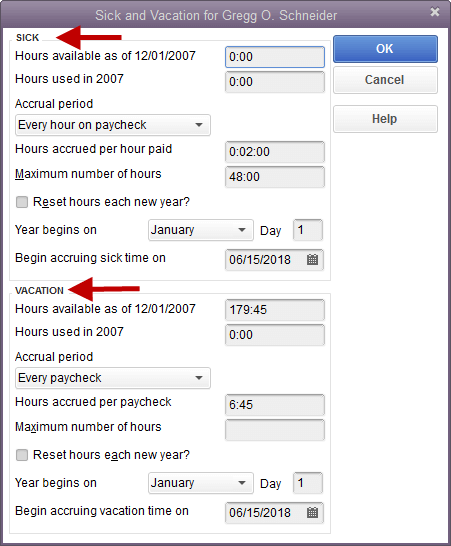

We'll use the employee's regular pay rate to calculate the hours on the paycheck.Īfter you set up a pay type for one employee, it shows up in the list, so it's easy to assign to other employees. Enter the number of hours the employee took for bereavement during the pay period. In British Columbia, for example, annual. their vacation pay would be 2308 (40,000 x 5.77 769.23 x 3 weeks 2308) In most employment regions, the number of vacation days an employee is entitled to increases after a set number of years. Under How much do you pay this employee click Add additional pay types if you haven't selected any other pay types, or click the pencil icon if you have. you’d calculate vacation pay at 3/52 (5.77) of their eligible earnings for each vacation week, and. Click the employee's name, and then click Edit employee. Next time you create a paycheck for the employee, the Bereavement Pay item appears. To add holiday pay to the payday page for an employee: In the left navigation bar, click Employees. In QuickBooks Desktop Payroll track holiday pay (or floating holiday pay) separately from sick or vacation pay.

#QUICKBOOKS DESKTOP PAYROLL SALARY PAYOUT VACATION UPDATE#

Simply click 'Finalise Payslips' to update the current period as well as the pre-pay periods.Īny pre-paid period will subsequently be blocked from editing when this pay period is selected in the payroll:

#QUICKBOOKS DESKTOP PAYROLL SALARY PAYOUT VACATION CODE#

Select a time off code to set up from the dropdown menu.

#QUICKBOOKS DESKTOP PAYROLL SALARY PAYOUT VACATION HOW TO#

A confirmation message will appear to state that that this is a 'pre-paying payslip' and will confirm the future pay periods that will be included on the payslip. How to set up accrual for vacation time, sick pay, and PTO: Go to Batch Payroll, Update Company Files, Company Information and select the Vac/Sick/Leave tab. ' and repeat the same process.ĥ) To finalise your pre-pay periods, return to your current open pay period by selecting this on the schedule bar. WellSky Personal Care is compatible with QuickBooks, Paychex, and ADP. as required in the pre-pay period:Ĥ) Pre-Paying more than one period - should you wish to pay an employee or employees more than one pay period in advance, within the pre-pay period, simply click "More" on the menu toolbar, followed again by 'Pre-Pay Following Week/Fortnight/Month/4-Week in this Week/Fortnight/Month/4-Week. Account for holidays, overtime, multiple pay rates, mileage, break time, and meal. '.Ģ) Select the employee(s) you wish to pay in advance and click 'OK'.ģ) In the current open pay period, click the on screen alert 'Go to Following Week/Fortnight/Month/4-Week'.Įnter the employee's payments, additions, deductions etc. To pre-pay an employee, click into the Payroll utility:ġ) Within the current open pay period, click "More" on the menu toolbar, followed by 'Pre-Pay Following Week/Fortnight/Month/4-Week in this Week/Fortnight/Month/4-Week. Find the right QuickBooks Desktop product for your business.

#QUICKBOOKS DESKTOP PAYROLL SALARY PAYOUT VACATION PRO#

To pay an employee in advance, a 'pre-pay' option is available within BrightPay. Compare QuickBooks Desktop Pro 2022, QuickBooks Premier 2022, and QuickBooks Enterprise 22.0. Processing Holiday Pay - Pre-paying in Advance

0 kommentar(er)

0 kommentar(er)